Large Investments – Decent Results

25. nov 2019

Orkuveitan

Results of Orkuveita Reykjavíkur‘s (OR; Reykjavík Energy) operations through Q3 2019 showed a profit of ISK 4.5 billion. Revenues slightly increased and expenses also, due to increased economic activities. The group’s interim consolidated financial statements for the first three quarters of the year were approved by the Board of Directors today. Besides the parent company, the group comprises ON Power, Veitur Utilities and Reykjavík Fibre Network.

OR Interim Financial Statements Q3 2019

Increasing Investments – Green Bonds

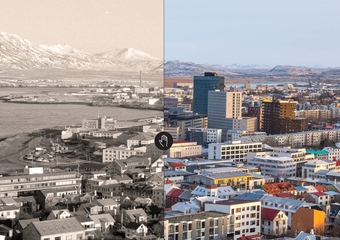

Construction of new residential housing in the company’s principal service area, along with necessary renewal of utility mains, are the main contributors to the rise in investments in the first nine months of 2019. Should forecasts materialise, this need will decrease in the next years. Therefore, decrease in investments is foreseeable. OR Group’s investments in fixed assets amounted to ISK 13.1 billion through Q3 2019, compared to ISK 10.4 billion in the same period for 2018.

Both new and maintenance investments in green energy systems are among the projects partially financed by the issuance of Green Bonds. The issuance commenced early in 2019. Demand for the green bonds has been strong, the investor base is more diverse than in earlier bond-offerings by OR, and rates have been favourable.

Ingvar Stefansson, CFO:

Reykjavík Energy’s financial position is solid. A sign of that is that while investments are considerable, the subsidiary Veitur Utilities has acknowledged the challenge of Icelandic labour unions and industrial associations to minimize tariff increases as a part of a general wage agreement in the Icelandic labour market. Equity ratio is roughly maintained and results of operations decent. The interest rates we get in financial markets also bear solid operations a witness.

There are interesting projects ahead. One of the group’s largest single investments in coming years is the upgrading of energy-use metering. That will extend over a few years and will allow us to improve customer service. Reykjavík Energy is leading in the fight against the climate crisis. We are constantly assessing the short- and long-term impact of climate change on our operations and evaluating how to best improve our resilience in that aspect. Furthermore, Reykjavík Energy and the subsidiaries play a vital role in enabling others to minimize their respective carbon footprint where the construction of infrastructure for energy-shift in transportation is vital.

| ISK million | Q3 2015 | Q3 2016 | Q3 2017 | Q3 2018 | Q3 2019 |

|---|---|---|---|---|---|

| Revenues | 28,951 | 29,921 | 31,310 | 33,459 | 33,578 |

| Expenses | (10,718) | (11,785) | (11,744) | (12,540) | (13,377) |

| EBITDA | 18,234 | 18,136 | 19,566 | 20,919 | 20,201 |

| Depreciation | (7,172) | (7,584) | (7,051) | (6,965) | (8,907) |

| EBIT | 11,061 | 10,551 | 12,515 | 13,954 | 11,294 |

| Income tax | 0 | (3,421) | (3,593) | (95) | 178 |

| Results for the period | 3,093 | 9,368 | 10,512 | 5,924 | 4,513 |