- Homepage /

- Finance /

- Financial news /

- Good Profit but Increased Capital Costs

Good Profit but Increased Capital Costs

22. aug 2022

Orkuveitan

© Atli Már Hafsteinsson

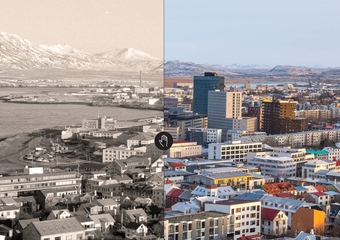

A five billion ISK profit was made from the activities of the Reykjavík Energy (Orkuveita Reykjavíkur; OR) group in the first six months of the year. Various inflationary effects can be seen in the consolidated interim financial statements of OR, which the board approved today. Within the group are, in addition to the parent company; Veitur Utilities, ON Power, Reykjavík Fibre Network, and Carbfix.

The income of most of the group's business units increased year-on-year. Aluminium prices remained at a higher level in the long term and increased income from the sale of electricity to heavy industry, and in the general market, the use of electricity and cold water increased, but the use of hot water decreased slightly between years. Income from new home connections decreased in line with the reduction in Veitur Utilities’ tariff for the service.

Events in the first half of the year

The severe weather that took place at the end of February caused some damage, especially to power lines and various electrical equipment in utility and power plant operations. At that time, the reservoirs of the hydropower plants in Iceland were very low, and the price of purchased electricity for resale on the public market rose temporarily. ON Power topped the Icelandic Customer Satisfaction scale in February, for the third year in a row. In May, Reykjavík Fibre Network’s green bonds were listed on Nasdaq Iceland's main market, and in the middle of the year the company's agreement with the Ministry of Foreign Affairs was announced regarding RFN’s use of two of the eight fibre optic cables in the so-called NATO-cable, which circles Iceland.

Around the same time, a grant amounting to ISK 16 billion from the European Union's Innovation Fund to Carbfix was announced for the development of the CCS centre Coda Terminal near Straumsvík.

A protracted court case regarding the settlement of currency contracts from 2008 ended in the first half of the year with OR being obliged to pay the bankrupt estate of Glitnir Bank approximately ISK three billion. The settlement was expensed in year 2021 but executed in February 2022 thus reducing cash flow from operation in the first six months of the year.

Inflationary effects

Various inflationary effects can be seen in the increase in operating costs in the first half of the year. Increased inflation leads to higher capital costs, and then the increase in imported inputs and contractor costs has increased maintenance costs and led to higher investments.

The group's operating profit (EBIT) in the first six months of the year increases by 1 billion ISK from the same period in 2021. However, higher capital costs and changes in figures related to aluminium prices lead to the company's profit falling by 3.8 billion ISK year-on-year, to 5 billion.

Bjarni Bjarnason, CEO

These are somewhat unusual times in the operations. There are a lot of investments, especially in the utility systems, and there is a lot of pressure to continue them, not least because of the focus of municipalities and the state on increasing the supply of residential housing. For this reason, the contractor market is tense and the lowest offers for work with us are sometimes tens of percent above budgets. At the same time, interest rates have risen very sharply, which should, other things being equal, discourage us from investing.

We at Reykjavík Energy will continue to participate in the necessary development. Although it is certainly more expensive now than often before, our finances are solid. That is why we have the resources to support strong housing development and energy shift in transport, but the climate crisis is not going anywhere.