Heavy investments at Reykjavik Energy and subsidiaries

23. nov 2020

Orkuveitan

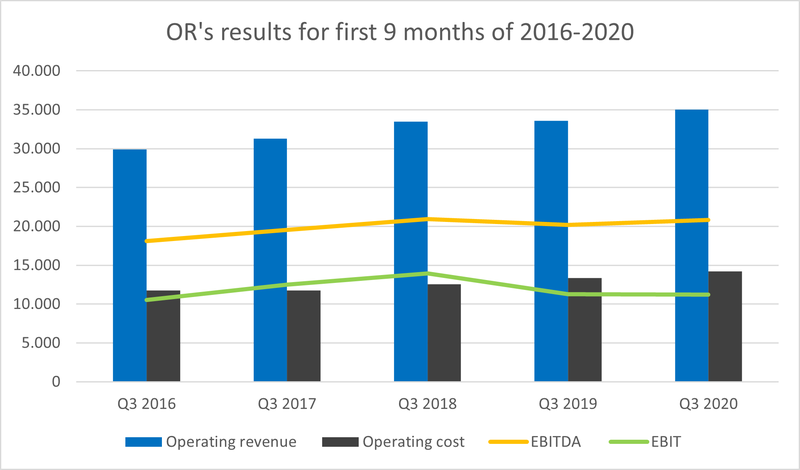

The operations of Reykjavik Energy (OR) have been stable in the first three quarters of 2020. The company is well positioned to push forward and thus increase investments to meet the impacts and implications of the Covid-19 pandemic on the Icelandic economy. Operating profit (EBIT) amounted to ISK 11.2 billion compared to ISK 11.1 billion for the same period last year. Operating margin amounted to ISK 20.8 billion, an increase of ISK 800 million from the third quarter financial statements in 2019.

Interim financial statements for the first nine months of the year were approved by OR’s board of directors today. The financial statements are statements for the entire group which, in addition to the parent company, is comprised of Veitur Utilities, ON Power, Reykjavik Fibre Network and Carbfix.

OR Interim Financial Statements Q3 2020

Heavy investments – strong cash position

In line with developments in the main service areas of the company and a decision about resistance investments due to Covid-19, investments were relatively high in the first three quarters of the year, amounting to ISK 11.4 billion. Main investments over the period are related to development and maintenance of the utilities systems – water, sewerage, heating and electricity – investments in new boreholes at the Hengill area as well as connecting homes with the fiber optic cable in the municipality of Árborg and the municipality of Reykjanesbær. Business development at Carbfix is also at full speed.

Investments are funded with the operating margin and borrowing. OR recently repaid a loan from the company’s owners which was given in the challenging years following the financial crisis. Currently, a loan from the Nordic Investment Bank (NIB) is being finalized for a total amount of USD 80 million for 15 years. The loan terms are much more favorable than on the loan from the owners, but the funding will be used to fund previously mentioned projects, which all are environmentally friendly.

Despite stability in operating profit, the interim financial statements show that there are considerable changes in financial items. They are mostly derived from a decrease in aluminum prices since the beginning of the year. Price for electricity, sold to Norðurál, is linked to aluminum price in long sales agreements. The price reduction in the period is calculated throughout the life of the agreement and stated in the interim financial statements according to international accounting standards. The impact of this on the total performance of the company in the first nine months of the year was considerable, or about ISK 2.8 billion. Negative exchange rate impact on operations is about ISK 4.6 billion. This is offset by a positive impact on equity of about ISK 7.4 billion due to exchange rate impact on balance sheet. This does not have an impact on operating profit, cash position or the ability of the company to invest. However, the impact is evident in the calculated total result of the interim financial statements, which now is positive of about ISK 0,7 billion but was in the same period in 2019 positive of about ISK 4.4 billion.

Bjarni Bjarnason, CEO

“No businesses are going through Covid-19 without facing challenges. We are constantly facing new challenges connected to the pandemic. We respond quickly but also seize the opportunities that this creates to improve and enhance the operations. It is relatively favorable to invest during these times; offers are often lower than in expansion periods and funding is favorable.

We decided as early as last winter to put efforts into special resistance investments due to the Covid-19 pandemic. Maintenance investments and the strengthening and enlargement of the utilities‘ systems are the most important this year but now it is also getting closer to one of our largest investment projects; updating 160.000 energy meters in the homes and businesses in our supply area. The old meters will be replaced with so-called smart meters. This replacement is a large step into the future, which we are excited to shape with our customers.

We were well prepared for Covid-19 with contingency plans in place and employees have shown great responsibility and respect for the importance of our service in communicating with customers and between themselves. Thus, we have been able to prevent that the pandemic would impact the important services that Veitur Utilities, ON Power and Reykjavik Fibre Network provide.”

| ISK million | Q3 2016 | Q3 2017 | Q3 2018 | Q3 2019 | Q3 2020 |

| Revenues | 29,921 | 31,310 | 33,459 | 33,578 | 35,045 |

| Expenses | (11,785) | (11,744) | (12,540) | (13,570) | (14,206) |

| EBITDA | 18,136 | 19,566 | 20,919 | 20,008 | 20,839 |

| Depreciation | (7,584) | (7,051) | (6,965) | (8,900) | (9,606) |

| EBIT | 10,551 | 12,515 | 13,954 | 11,108 | 11,233 |

| Cash flow statement | |||||

|

Net cash from operating activities |

17,305 | 18,625 | 17,217 | 19,449 | 19,416 |

|

Working capital from operation |

14,853 | 15,080 | 16,830 | 14,275 | 15,727 |

| Key financial ratios | |||||

| Equity ratio | 39.5% | 43.7% | 46.8% | 47.1% | 47.4% |

|

Current ratio* |

0.8 | 1.0 | 1.1 | 1.0 | 0.9 |

| *without aluminum derivative |