Reykjavík Energy's Consolidated Financial Forecast 2023-2027 Approved

3. oct 2022

Orkuveitan

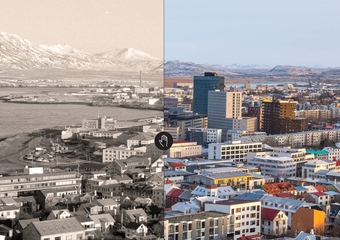

Reykjavík Energy’s (Orkuveita Reykjavíkur; OR) consolidated financial forecast for the years 2023-2027 assumes strong growth in investments and operations. The drivers are mainly two; expansion and construction of Veitur Utilities’ distribution systems due to new housing and new transport infrastructure in Iceland’s Capital Area and the construction of Carbfix’ s mineralization facilities for carbon dioxide. A total of ISK 184 billion is expected to be invested in the years 2023 to 2027. Bjarni Bjarnason, CEO of Reykjavík Energy, believes that companies in the OR group and their staff are well equipped to deal with these large-scale projects.

The financial forecast is consolidated for Veitur Utilities, ON Power, Reykjavík Fibre Network, and Carbfix as well as the parent company. It is based on forecasts approved by the respective subsidiary’s BoD and was approved by Reykjavík Energy’s BoD today. The forecast will be discussed in the Reykjavík City Council as a part of the City's consolidated budget.

The CODA Terminal Included in Forecast

The financial forecast assumes that Carbfix will invest around ISK 40 billion in the fight against climate change by building a CO2 transport and mineralization hub and on further research to develop the Carbfix method, which permanently turns the greenhouse gas to stone. The most advanced plans are for Straumsvík, where the CODA Terminal will be constructed. Investments there will be highest in the years 2024 and 2025. Preparations for the sale of new shares in Carbfix are ongoing to finance part of the investments, and the CODA Terminal project has received generous support from the EU’s Innovation Fund.

Combined State and Municipal efforts to speed up the development of residential housing and the implementation of the Capital Area Transport Agreement are added to Veitur Utilities’ traditional projects of maintaining and developing waterworks, electric grid, heating utilities and sewerages in the south and west of the country. There are already signs of strain in the contractor market, that can risk the Veitur´s investment plans in the planning period. Veitur’s implementation of smart energy metering will be completed during the forecast period.

Energy Shift and a New National Ring of Telecommunications

Increased sustainability through better utilization and less waste is the guiding principle of ON Power’s development in the coming years. There are no plans to increase the generation of electricity, but to improve and increase the use of what is already produced. Investment plans assume geothermal drilling and improved steam supply for Hellisheiðarvirkjun, as well as measures to reduce the environmental footprint of the operation. Business development will be increasingly important, as support for energy transitions, especially in transport, and further development of circular economy concepts in ON Power’s Geothermal Park are in the foreground. The Geothermal Park already houses several progressive innovative companies that use, among other things, the by-products of geothermal processing. During the period of the forecast, it is expected that activity in the Geothermal Park will increase considerably, and thereby revenues from it.

Reykjavík Fibre Network (RFN) has led the implementation of fibre to the homes in Iceland. In the last months, RFN has responded to the changing conditions in the telecommunications market with an increased focus on services for telecommunication companies. The further development of a new national telecommunications network is a part of that change. The financing those investments and other necessary investments are planned by raising new equity in the company. There are however regulatory restrictions on Reykjavík Energy’s providing new funding. Therefore, the financial plan assumes an increase in share capital with the participation of new investors, for which authorization from the owners of Reykjavík Energy is required.

Solid Operations and Finances

Strong operations and balance sheet enables Reykjavík Energy to support this expansion and at the same time pay dividends to owners. Hence, the financial forecast assumes a total of ISK 27.5 billion in dividends to owners during the forecast period. The equity ratio will increase during the period of the forecast.

The extensive advancement of heating utilities and the increased supply of hot water as well as the strengthening of electricity utilities due to energy transition necessitates an increase in the tariffs for these services. However, the forecast assumes that the water tariff will decrease in year 2023 and the sewerage tariff will remain unchanged, despite inflation.

Bjarni Bjarnason, CEO:

It is a big task to ensure that this expansion of the Group will be sustainable and future generations will benefit from it rather than experience it as a burden; financially, socially, and environmentally. Large investments call for The Reykjavík Energy Group, as a workplace, to withstand the anticipated load and for investment projects to be carefully monitored.

The large projects ahead extend to all the companies in the Reykjavík Energy Group and all aim to improve the sustainability of society we jointly operate and increase the quality of life. It is very important that we succeed, and I believe that the group's employees are well prepared for the projects.