- Homepage /

- Finance /

- Financial news /

- Planned bond issuance

Planned bond issuance

23. sep 2020

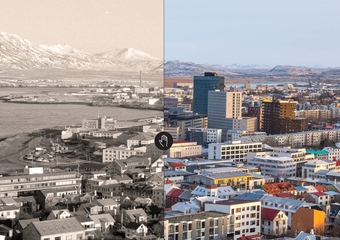

Orkuveitan

In a press release from April 8th regarding financing and actions taken by Reykjavik Energy (OR) and its subsidiaries due to Covid-19 it was stated that authorization for financing in the form of bonds, bills and bank loans in 2020 had been increased from ISK 13bn to ISK 30bn. The reasons for this increased financing need, as stated in the press release, are increased investments and dividend payments, refinancing of loans to owners and expectations of generally worse economic conditions.

In a press release from April 14th it was furthermore stated that approximately half of this year‘s financing was anticipated to be in the form of bank loans from domestic and international banks, with the remainder financed by issuing bonds in the domestic bond market.

A decision has been made to increase the proportion of bond issuance this year and decrease the proportion of financing with bank loans. Authorization for financing in 2020 is unchanged, ISK 30bn.

Sofar in 2020, OR has issued bonds amounting to ISK 14.5bn. All bond financing in 2020 has been through issuing green bonds. Bond issuance for the remainder of the year is expceted to be between ISK 7 - 12bn, depending on pricing and market conditions.

OR‘s financial position is strong. At the end of Q2 2020, OR had about ISK 28bn of cash and marketable securities.