- Homepage /

- Finance /

- Financial news /

- Reykjavík Energy Budget | Leadership on Climate and Energy Transition

Reykjavík Energy Budget | Leadership on Climate and Energy Transition

29. oct 2024

Orkuveitan

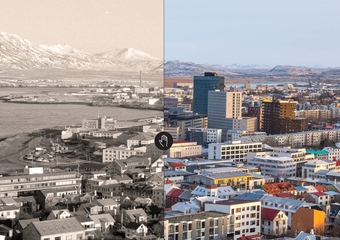

Reykjavik Energy's (Orkuveitan) financial forecast for the years 2025 to 2029, which was approved by the board on October 28th, includes the company's ambition to be an enabler for a sustainable future, which is the title of the company's overall strategy. Considerable growth is expected during the period in this summarized forecast for Veitur Utilities, ON Power, Reykjavík Fibre Network, and Carbfix, as well as the parent company. The forecast of each subsidiary within the Group had previously been approved by the respective BoD. The consolidated forecast will be further deliberated as a part of the City of Reykjavík's budget.

Investments reflect new strategy

The financial forecast reflects Orkuveitan's strategic focus on investments to secure future electricity and heat production while also maintaining, strengthening, and expanding robust utility networks. The efficiency of current power plants will be improved, supporting the further development of a circular economy connected to geothermal utilization, while a significant step will be taken in increasing carbon capture with Carbfix.

The forecast assumes, among other things, that;

- Annual income grows from ISK 66.4 billion in the outcome forecast for 2024 to ISK 88.1 billion in 2029, or about 33%.

- Annual operating costs grow from ISK 29.2 billion to ISK 34.4 billion or about 18%.

- Cash from operations grows from ISK 30.4 billion to ISK 39.8 billion 2029, or about 31%.

- Orkuveitan's equity grows from ISK 260.0 billion at the end of 2024 to ISK 333.7 billion at the end of 2029 or about 28%.

Exciting times ahead says Saevar Freyr, CEO

“Exciting times are ahead for us at Orkuveitan,” says Saevar Freyr Thrainsson, CEO of Orkuveitan. “We intend to participate in the green growth of society and lead it in many areas. We will strengthen and expand our energy production and seek partnerships to make this resource benefit the green initiatives of other operations as well,” Saevar Freyr adds.

The financial forecast anticipates total investments over the five-year period from 2025-2029 to reach ISK 227 billion. Most of this will be financed by operational income, with an expected net borrowing of nearly ISK 37 billion. Additionally, it is planned that Carbfix’s largest project, the Coda Terminal carbon capture and storage facility, will be partially funded through external equity, as this is a prerequisite for moving forward with the project.

Uncertain timing of individual tasks

In the report accompanying the financial forecast, it is noted that the timing of some of Orkuveitan's investments depends on the decisions of others, such as the government and municipalities. The pace of residential and commercial development is partly in the hands of municipalities and developers, and permitting processes have a significant impact on when specific investments in energy production and carbon capture can proceed.

“As we pave the way for the necessary green transition, we will also ensure that we uphold the core services entrusted to us,” says Saevar, referring to the diverse utility services enjoyed by roughly three out of every four residents in the country. The electricity and heating utilities are foundational to the country’s initial energy transition. “Core services will remain reliable and fairly priced,” he adds, “but we are also transparent about our aim to secure better prices for electricity from major consumers. Current contracts, which have been in place for some years, include the cost of energy transmission, which we want buyers to pay directly.”

Contact:

Snorri Hafsteinn Thorkelsson

CFO

snorri.hafsteinn.thorkelsson@orkuveitan.i

Attachment