- Homepage /

- Finance /

- Financial news /

- Reykjavik Energy | Renewal of market-making contracts

Reykjavik Energy | Renewal of market-making contracts

28. jan 2025

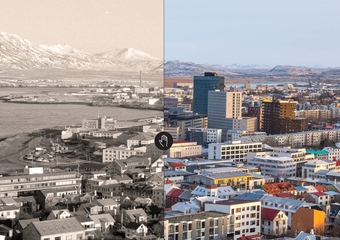

Orkuveitan

Reykjavik Energy (Orkuveita Reykjavíkur; Orkuveitan) has signed agreements with Kvika banki hf., Landsbankinn hf. and Fossar Investment Bank hf., on market making in the secondary market for bonds issued by Reykjavik Energy with the tickers "OR031033 GB", "OR180242 GB", "OR280845 GB" and "OR180255 GB". The bonds have already been admitted to trading on Nasdaq Iceland. According to the agreement, the obligations of market makers took effect on 27 January 2025. Market making with OR 031033 GB and OR 280845 GB will start on February 10, 2025.

The agreements' purpose is to promote trading in the bonds contractually covered, increase their liquidity in the secondary market, and promote normal price formation.

Market makers undertake to submit bids and offers for the bonds on the Stock Exchange each day before market opening. Bids shall always be at least ISK 20 million in each series at nominal value, and bids shall be renewed within 15 minutes of being accepted.

The maximum difference between market makers' bids and offers is determined by the price of valid bids and may not exceed 1.0% per OR 031033 GB. The maximum difference between bids and offers between OR 180255 GB, OR 280845GB and OR 180242 GB may not exceed 1.5%.

Reykjavik Energy will expand the OR categories 031033 GB and OR 280845 by ISK 480 million at face value in both categories. The shares will not be sold to investors, but the increase is to enable Reykjavik Energy to meet its obligations to grant securities loans in connection with the market making.

Contact:

Snorri Hafsteinn Þorkelsson

Chief Financial Officer of Reykjavik Energy

Phone: 516 6100

Email: snorri.hafsteinn.thorkelsson@or.is