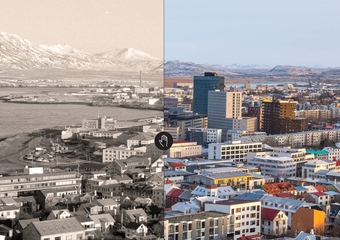

Reykjavík Energy Returns Good Results in 2021

8. mar 2022

Orkuveitan

Reykjavík Energy (OR; Orkuveita Reykjavíkur) financial performance was good in 2021 and the carbon footprint of the Group decreased from the previous year. Within the Group, in addition to the parent company, are Veitur Utilities, ON Power, Ljósleiðarinn-Reykjavík Fibre Network, and Carbfix. OR’s consolidated annual financial statements were approved by the Board of Directors today and carry a profit of ISK 12 billion from operations. The Board of Directors proposes to the Annual General Meeting that a dividend of ISK 4 billion be paid to thew owners. The owners of Orkuveita Reykjavíkur are the City of Reykjavík, and the municipalities of Akranes and Borgarbyggð.

OR Consolidated Financial Statements 2021

Operating expenses decrease between years

The operating expenses of the OR Group decreased between the years 2020 and 2021. At the same time, the price of aluminium rose, which increased ON Power’s income from electricity sales to power-intensive industries. The real-term price of Veitur Utilities' licensed services decreased slightly during the year.

OR Annual Report 2021

Along with the financial statements, Reykjavík Energy publishes its integrated Annual Report. The report gives a detailed account of the environmental and climate aspects of the Group’s operations last year, social factors and governance, as well as various financial metrics. The Group's carbon footprint decreased between 2020 and 2021 and is forecast to decrease further in the coming years with increased carbon mineralization at ON Power’s geothermal power plants.

The annual report is audited by independent parties and endorsed by the CEO and the board. It can be found at https://annualreport2021.or.is.

Bjarni Bjarnason, CEO of OR:

Now that we are emerging from the Covid-pandemic, I am most grateful to the employees of the companies in the Reykjavík Energy Group. In the last two years, there has been to our knowledge no instance of outage of our important basic services due to the pandemic and we do not know of any case of a group infection at our workplaces.

At the same time, we maintain a solid grip on operations so that favourable external conditions are quickly and efficiently reflected in the Group’s results, thus benefiting our customers.

The public's expectations for services and Reykjavík Energy’s positive impact on the environment and society are growing. Therefore, it is especially gratifying to see results of measurements that indicate increased customer satisfaction. We are constantly looking for new ways to shorten the communication channels to us, provide clearer information quickly and efficiently and to do this in a more efficient way than before. I assert that we have succeeded in many ways, but at the same time I promise that we will continue to improve.

| 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | Unit | |

| Operating revenues | 40,312 | 41,423 | 43,666 | 45,916 | 46,570 | 48,627 | 51,890 | ISK mill. |

| Operating expenses | -15,183 | -16,062 | -17,285 | -17,299 | -18,398 | -19,172 | -18,380 | ISK mill. |

| EBITDA | 25,174 | 25,361 | 26,380 | 28,617 | 28,172 | 29,454 | 33,510 | ISK mill. |

| EBIT | 14,428 | 14,968 | 17,318 | 18,346 | 16,051 | 16,398 | 20,253 | ISK mill. |

| Gender pay-gap | 2.30% | 2.10% | 0.20% | 0.00% | 0.10% | 0.00% | -0.20% | % |

| Job satisfaction | 4.3 | 4.4 | 4.4 | 4.4 | 4.3 | 4.4 | 4.3 | Grade 1-5 |

| Hot water | 83 | 78 | 94 | 101 | 101 | 110 | 106 | mill.m3 |

| Electricity | 3,249 | 3,411 | 3,473 | 3,507 | 3,536 | 3,581 | 3,545 | GWh |

| Potable water | 29 | 30 | 29 | 28 | 29 | 26 | 26 | mill.m3 |

| Data via Ljósleiðarinn | 122,000 | 155,000 | 180,000 | 216,000 | 260,000 | 345,000 | 396,000 | TB |

| Carbon footprint | 67,100 | 45,450 | 42,700 | 45,450 | 48,750 | 50,550 | 48,650 | tn. CO2-eq. |

| Mineralized CO2 | 5,200 | 9,000 | 12,000 | 12,000 | 10,500 | 11,700 | 13,300 | tonnes |

| Gender pay-gap | 2.30% | 2.10% | 0.20% | 0.00% | 0.10% | 0.00% | -0.20% | % |