- Homepage /

- Finance /

- Financial news /

- Reykjavík Energy's Consolidated Financial Forecast 2024-2028 Approved

Reykjavík Energy's Consolidated Financial Forecast 2024-2028 Approved

2. oct 2023

Orkuveitan

© Einar Örn Jónsson

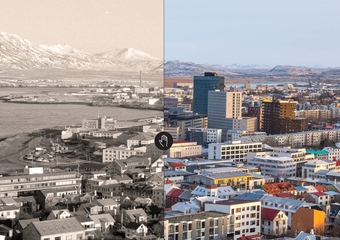

Reykjavík Energy’s (OR; Orkuveita Reykjavíkur) consolidated financial forecast for the period 2024-2028, which was approved by the Board of Directors today, reflects expectations for a significant increase of new housing, which Veitur Utilities’ systems will serve, Carbfix’ ambitious development of a new carbon transport and storage hub at Straumsvík, growing telecommunications services of Reykjavík Fibre Network, and ON Power’s emphasis on circular economy and energy transition.

The forecast covers the years 2024 through 2028 and is summarized for Veitur Utilities, ON Power, Reykjavík Fibre Network, and Carbfix, as well as the parent company. The forecast of each subsidiary within the Group had previously been approved by the respective BoD. The consolidated forecast will be further deliberated as a part of the City of Reykjavík's budget.

Increasing revenues

The increased revenues of the Group in the forecast period can be mainly attributed to the growing demand for utility services accompanying population increase in the Group’s service areas. Authorities have ambitious plans in that regard. Increased income from wholesale of electricity and the strengthening of new and recent sources of revenues is also forecasted, such as from the operation of ON Power’s Geothermal Park by the Hellisheiði Power Plant, RFN’s expanding services, and from the carbon disposal of Carbfix.

Among assumptions in the forecast, is that tariffs will be broadly in line with inflation but, in real terms, Veitur Utilities’ tariffs have decreased slightly in recent years. Along with increased revenues, profitability is forecast to rise.

The forecast assumes that the Group's annual income will increase from ISK 65.1 billion in 2024 to ISK 97.9 billion in 2028. That's 50.4% growth and annual operating costs are expected to grow by 29.1% in the same period.

Important investments for the future

The largest single investment project during the forecast period is the construction of Carbfix’ Coda Terminal carbon transport and storage hub. The project is unique on a global scale and marks a turning point in the fight against the climate crisis. In the hub at Straumsvík, it is planned to receive carbon dioxide, which is transported there by sea, and sequester it as a mineral in the lava fields by Straumsvík. The method is proven at the Hellisheiði Power Plant, where it was developed and tested with great success. Among ON Power’s investments during the period of the financial forecast is increasing the proportion of carbon dioxide that is captured and sequestrated from the steam, utilising the Carbfix technology and initiating the construction of a similar treatment plant at the Nesjavellir Power Plant.

The development of utility systems, including the construction of a new national telecommunications network, is also substantial in the budget. During the forecast period, Veitur’s initiative for smart metering will also be completed, and the company will invest additional funds in research and development to ensure access to sufficient hot water reserves for the long term. The sustainability of energy production at Hellisheiði will be enhanced by laying a new steam pipe from the geothermal area at Hverahlíð. The new pipe will be parallel to the existing one.

A total of almost ISK 230 billion is expected to be invested by Orkuveita Reykjavíkur Group in the years 2024-2028.

Diversified financing

In recent years, the financing of the OR Group’s investments has mostly been with money from the operations and funds raised on the domestic market, mainly through the issuance of green bonds by OR and Reykjavík Fibre Network. OR's international credit rating is good, and it is therefore feasible to increasingly turn to international institutional banks.

There is also a watershed in the OR Group that, in the year 2024, two companies within the Group – Reykjavík Fibre Network and Carbfix – will be co-owned with other parties. The refinancing of RFN by increasing equity is intended to strengthen the company's balance sheet and reinforce it as a key player in healthy competition in the telecommunications market, for the benefit of the public and companies in the country. The sale of shares in Carbfix is to accelerate the development of the company and support investments, both in Iceland and abroad.

Sævar Freyr Þráinsson, CEO:

"OR’s consolidated financial forecast reflects the ambition that the companies in the Group have for people's quality of life and to be an enabler of a robust, green, economy. With extensive investments in infrastructure, we support the positive growth of society through continued leadership in the energy transition, including interesting ideas for increased energy production.

Demand for the green products and services of the companies in the OR Group is growing fast. This includes our traditional green utilities, the renewable energy we generate, and now new technologies to tackle the climate crisis.

Our ambition is based on the great knowledge of the staff of all the companies, their desire to serve current customers even better, while the perspective of sustainability encourages us to look to the long future.

This forecast includes fundamental projects for our benefit and the benefit of future generations, and in the financial forecast we show how we intend to make them come true. There are certainly various uncertainties in the environment, but I believe that the solid financial position of the Group, a good grasp of the operations of the companies, and a sharp common vision will bring us important milestones in the coming years."

Outcome forecast 2023

The consolidated financial forecast also includes an outcome forecast for the current year. A profit of around ISK six billion is expected from the Group's activities this year. The main deviations from what was proposed a year ago are that investments in Coda Terminal were delayed and sale of shares. Inflation has also been more persistent than was expected in the assumptions of previous forecasts.