- Homepage /

- Finance /

- Financial news /

- Solid Results for Reykjavík Energy Through Q3 2021

Solid Results for Reykjavík Energy Through Q3 2021

22. nov 2021

Orkuveitan

The results in Orkuveita Reykjavíkur's interim consolidated financial statements for the first nine months of the year are very good. Operating expenses, compared to the same period in 2020, have decreased by over 6% and increased income, partly due to higher aluminium prices, explain a solid result. According to Bjarni Bjarnason, CEO of OR, the results reflect management’s solid grip on operating costs. As a result, favourable external conditions such as higher aluminium prices and lower interest rates result in improved bottom-line results.

The OR Group's interim financial statements for the first nine months of 2021 were approved by the Company’s Board of Directors today. In addition to the parent company, the group includes Veitur Utilities, ON Power, Reykjavík Fibre Network and Carbfix.

Operating expenses decrease

Operating expenses through Q3 decrease year on year, 2020 and 2021, by ISK 867 million or 6.1%. Expenditure on electricity purchases and electricity transmission decreases slightly between years, as do salaries expenses, while other operating expenses decrease by almost one-fifth.

Revenue from all segments grows between years and EBIT amounts to ISK 14.4 billion, compared to ISK 11.2 billion in the first nine months of 2020.

ISK 10.6 billion fluctuations due to aluminium prices

Reykjavík Energy’s financial statements assess the value of long-term power purchase agreements. If their value increases or decreases, the difference is recognized in the income statement. At the beginning of the coronavirus pandemic, aluminium prices fell sharply, and as part of OR’s electricity sales is linked to aluminium price, the value of such agreements was reduced in the Company’s calculated results for 2020. Reversely, year 2021 has seen considerable increase in the price of aluminium. Through Q3 2020, the value of these long-term agreements related to aluminium prices was estimated to have decreased by ISK 2.75 billion, but in the current year's income statement it is estimated to have increased by ISK 7.86 billion. The year-on-year fluctuation of this calculated metric amounts to more than ISK 10.6 billion.

When looking at cash flow, actual funds in the interim financial statements and not calculated amounts, the effects of lower operating costs and increased revenue from the service components are clear. Cash from the operations of Reykjavík Energy and its subsidiaries amounted to ISK 21.8 billion through Q3 2021, compared to ISK 19.4 billion for the same period in 2020.

Bjarni Bjarnason, CEO:

In these financial statements, we see yet again that a strong grip on operating costs within the Group is paramount to favourable external conditions being reflected in a good overall result. Disregarding calculated figures in the statements, the operating result would be positive by ISK 6 billion. It is a fair yield of the money the owners have committed to these operations.

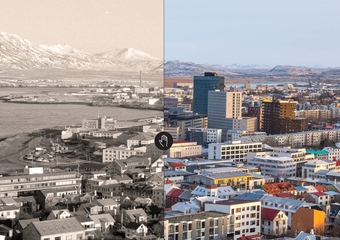

Due to these favourable results, we can continue to offer our services at favourable prices. Veitur Utilities’ connection fees have recently been reduced and it is now clear that there will be a real-term reduction in cold water price, as household water tariffs will remain unchanged through next year. Concurrently, our sound financial position allows us to ensure the future quality of services, their development and progress. Increased automation, greater reliability, and the resilience of our utility system to climate changes are key factors so that these basic needs will also be fulfilled for future generations at a reasonable price.

Key figures for RE's finances

The key figures for the OR Group's finances are published on Orkuveita Reykjavíkur's website, together with the financial targets that are being pursued.

The URL is or.is/en/finance/key-financial-figures/